IN TODAY'S ISSUE:

- We break down the structural differences between gold and bitcoin that help explain bitcoin’s relative underperformance.

- Following last week’s setback in crypto legislation, we assess the implications and what may come next.

Geopolitical Upheaval: Gold Shines While Bitcoin Slides

Over the weekend, markets were roiled after President Trump escalated trade rhetoric by threatening broad new tariffs on multiple European countries, a move tied to renewed geopolitical pressure related to the U.S.’s interest in Greenland. The announcement sparked a sharp risk-off reaction across global markets, with U.S. equity futures selling off, volatility rising, crypto moving lower, and precious metals soaring. While Trump later partially walked back the tariff threats, helping markets stabilize, a move that defines his negotiation tactics, the episode reinforced how abrupt policy rhetoric can still drive short-term volatility for crypto investors, even absent direct crypto-specific implications.

Frustratingly for crypto investors, the episode interrupted the budding momentum that had been building since the start of the year, a genuine gut punch for the market. Adding insult to injury, precious metals surged to new highs as capital rotated into traditional safe havens. And while the evolving geopolitical and macroeconomic backdrop would, in theory, favor an asset like bitcoin, market behavior has thus far diverged meaningfully from that narrative.

While bitcoin has not reliably served as a hedge against equity market drawdowns, a point we’ve examined extensively, it is nevertheless worth revisiting why bitcoin and the broader crypto market may be failing to attract greater support in the face of the unfolding macro and geopolitical developments.

Trapped in a Risk Asset Regime

We are no fans of bimodal market descriptors, risk-on or risk-off, but for whatever reason, it remains the most accessible framework for a broad investing audience, even if it obscures the influence of liquidity conditions, positioning, macro policy, and idiosyncratic flows. Viewed through that lens, bitcoin continues to behave more like a risk asset than a macro hedge: its rolling 90-day correlation with U.S. equities remains elevated, most recently registering around 0.51, underscoring the market’s tendency to trade crypto alongside equities during periods of heightened volatility.

Gold and the Institutional Playbook

While bitcoin has made meaningful inroads with institutional investors, family offices, and high-net-worth individuals, especially since the launch of spot ETFs 2 years ago, it still falls short of gold in terms of broad acceptance within professional portfolios. Gold benefits from decades of institutional precedent and a well-established role as a strategic allocation across market cycles, whereas bitcoin remains earlier in its adoption curve. As a result, many allocators continue to view bitcoin tactically rather than structurally, limiting its use as a portfolio hedge.

Liquidity Preferences Working Against Bitcoin

Under periods of stress and uncertainty, liquidity preference dominates, and this dynamic hurts bitcoin far more than gold. Bitcoin is highly liquid and tradable 24/7, making it one of the few assets that can be sold immediately when other markets are closed or impaired. Despite being liquid for its size, bitcoin remains more volatile and reflexively sold as leverage is unwound. As a result, in risk-off environments, it is frequently used to raise cash, reduce VAR, and de-risk portfolios regardless of its long-term narrative, while gold continues to function as a true liquidity sink.

Risk Duration Differences

There is a clear time-horizon mismatch between gold and bitcoin as hedges. Current geopolitical stress is being priced by markets as episodic, reversible, and ultimately policy-manageable, which favors assets that hedge near-term uncertainty rather than long-term regime change. This past week is a good example. Gold excels in moments of immediate confidence loss, war risk, and fiat debasement that does not involve a full system break. Bitcoin, by contrast, is better suited to hedging long-run monetary and geopolitical disorder and slow-moving trust erosion that unfolds over years, not weeks. As long as markets believe the present risks are dangerous but not yet foundational, gold remains the preferred hedge.

Large Seller Overhang

Last summer, we tracked the movement of coins tied to the so-called “July 4th Whale,” a large long-term holder that ultimately sold roughly $9 billion worth of bitcoin. While that episode was the most striking example of whale-driven selling, similar events are now commonplace. For example, earlier this week, $84 million of long-held bitcoin was moved, possibly to a service provider/exchange, another sign that large holders continue to distribute, weighing on market prices.

The opposite dynamic is playing out in gold. Large holders, particularly central banks, continue to accumulate the metal. While the U.S. may eventually pursue a comparable strategy with a strategic bitcoin reserve, there is currently no concrete plan in place.

Specter of 4-Year Cycles

Adding to these pressures is the specter of bitcoin’s four-year cycle, which continues to loom over investor sentiment. Despite structural improvements in market maturity, many participants remain conditioned by prior cycles in which post-halving strength ultimately gave way to a prolonged drawdown. We called this the "null hypothesis." As a result, concerns about a familiar pattern reasserting itself may be dampening risk appetite, encouraging profit-taking, and sidelining capital in the absence of a clear upside catalyst. In a tighter liquidity environment, this fear of repetition can become self-reinforcing, leaving bitcoin more vulnerable to negative macro developments and reinforcing its near-term underperformance relative to more established defensive assets like gold, even as its longer-term investment thesis remains intact.

Picking Up Pieces Following Failed Crypto Legislation

The state of U.S. crypto legislation took a notable step backward last week when a planned markup of the Senate’s market structure bill was abruptly canceled in the Senate Banking Committee. At this stage of the legislative process, such reversals are highly unusual and underscore the fragility of consensus around digital asset regulation and perhaps some naivety by industry participants. The immediate catalyst was public opposition from Coinbase CEO Brian Armstrong, who stated that the draft contained “too many issues” for the company to support. Given Coinbase’s central role in shaping industry alignment, the withdrawal of support proved decisive and dealt a significant blow to near-term legislative momentum.

While Armstrong cited various unworkable provisions in the bill, amendments targeting stablecoin rewards have been the most controversial. The banking industry has sought to close a GENIUS Act “loophole” that allows companies such as Coinbase to pay rewards to holders of stablecoins, such as USDC, on their platform. Although the GENIUS Act prohibits stablecoins from paying interest directly to holders, this indirect reward structure remains viable under current law. The proposed changes would largely eliminate that distinction, a line Coinbase has indicated it is unwilling to cross.

The legislative setback comes at an inopportune time. With midterm elections approaching, lawmakers’ attention is increasingly shifting toward housing affordability and other voter-salient issues, compressing the window for comprehensive crypto reform. To realistically clear Congress and reach the President’s desk, a finalized bill would need to be in place well ahead of elections in November, a timeline that now appears challenging. The result is a heightened risk of prolonged regulatory ambiguity, a dynamic that has weighed on participation in U.S. digital asset markets for years.

That said, the broader policy environment remains materially more constructive than in prior years. The current administration and key regulators have expressed greater openness to digital asset innovation than under the Biden administration, even as explicit clarity remains elusive. At the same time, recent limits placed on regulatory authority through the rollback of Chevron deference may constrain how far the SEC and CFTC can go absent explicit congressional authority, one of the reasons why this legislation remains so pivotal. Ironically, this effort to rein in regulators, largely driven by conservative legal priorities, may ultimately lead to further delays in setting the rules of the road for the crypto industry. For institutional participants, the near-term outlook suggests some uncertainty, but not a wholesale reversal of the longer-term trend toward eventual regulatory normalization.

Market Update

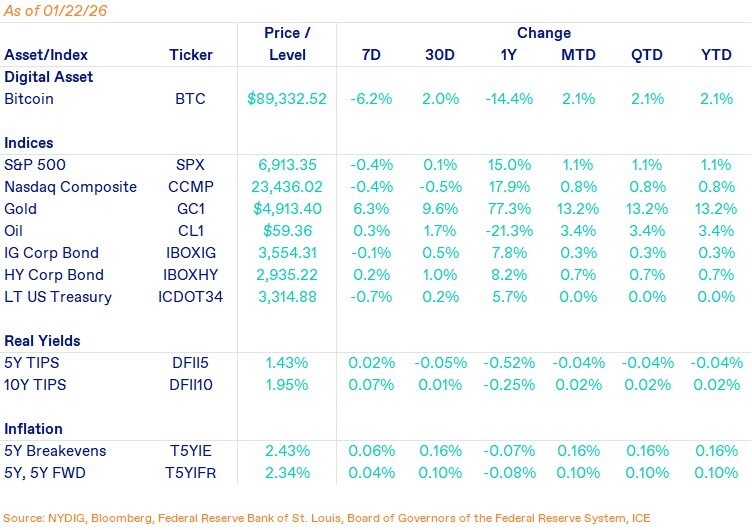

Bitcoin fell 6.2% on the week, reversing some of the early gains that had characterized the start of the year. Momentum faded after news broke of potential tariffs proposed by President Trump, tied to his stated interest in acquiring Greenland. The headlines injected a renewed dose of geopolitical uncertainty into markets, weighing on risk appetite broadly. While prices managed a modest rebound off the lows, the damage to the nascent momentum was evident. Year-to-date, bitcoin remains modestly up, but sentiment has clearly softened following the pullback.

The broader macro backdrop reinforced this divergence. U.S. equities edged lower on the week, with both the S&P 500 and Nasdaq Composite down roughly 0.4%. In contrast, gold surged 6.3% on the week and is now up 13.2% year-to-date, underscoring a renewed bid for haven assets amid rising policy and geopolitical uncertainty. Bonds were mixed, with credit largely flat and long-dated Treasuries slightly weaker, while real yields continued to drift lower at the front end.

Within crypto, market structure metrics continue to point to muted risk appetite. Funding rates on perpetual swaps remain subdued, and the annualized basis on CME-listed bitcoin futures is roughly 4–5%, levels more consistent with investor apathy. Together, these indicators suggest positioning is light, and conviction remains low, even after the recent pullback.

Important News This Week

Investing:

Bitcoin Whale Wakes Up After 12 Years to Move $84 Million Fortune - CoinDesk

Wall Street Pulls Back from Bitcoin’s Money-Spinning Basis Trade - Bloomberg

UBS Plans Crypto Trading for Some Clients in Digital-Asset Push - Bloomberg

Bitcoin Struggles to Regain Momentum Amid Persistent Overhead Supply: Glassnode - The Block

Regulation and Taxation:

Crypto Bill Delayed as Senate Panel Pivots to Trump Housing Push - Bloomberg

Companies:

The New York Stock Exchange Develops Tokenized Securities Platform - NYSE

Coinbase Establishes Independent Advisory Board on Quantum Computing and Blockchain - Coinbase

Strive Proposes $150 Million Sale of SATA Preferred Stock to Repay Debt, Buy BTC - CoinDesk

BitGo Prices IPO At $18, Pitching Custody Growth Over Crypto Trading Swings - CoinDesk

Ledger Eyes $4B NYSE IPO with Goldman, Jefferies and Barclays - CoinDesk

Upcoming Events

Jan 28 - FOMC interest rate decision

Jan 30 - CME expiry

Feb 11 - CPI release